Selecting the optimal fuel tanker truck capacity is the cornerstone of efficient and cost-effective fuel transportation across all global markets, from the busy industrial corridors of North America to the growing energy hubs in the Middle East and the dense urban landscapes of East Asia. Every decision around fuel tanker truck capacity directly shapes supply chain resilience, operational costs, and safety compliance for fuel distributors, retailers, and industrial fuel suppliers alike.

In the dynamic fuel transportation industry, the wrong fuel tanker truck capacity can lead to crippling inefficiencies—either excessive trips that drive up labor and fuel costs for small-capacity fleets, or underutilized large-capacity tankers that waste capital and struggle with logistical constraints. For businesses operating across continents, aligning fuel tanker truck capacity with regional demand patterns, road regulations, and storage infrastructure is not just a logistical choice, but a strategic one that impacts bottom-line profitability and market competitiveness. Whether you’re delivering gasoline to rural gas stations in Asia, diesel to manufacturing plants in the Middle East, or aviation fuel to airports in North America, getting fuel tanker truck capacity right ensures seamless fuel delivery, minimized carbon footprints, and adherence to local and international transportation standards.

Understanding Fuel Tanker Truck Capacity Ranges and Global Applications

Fuel tanker trucks are categorized by capacity into three core types, each engineered to meet distinct fuel transportation needs across the Americas, Middle East, and East Asia. The scalability of fuel tanker truck capacity is what makes it possible to serve everything from small agricultural operations to mega industrial complexes, with each range offering unique advantages for specific use cases.

Small-Capacity Fuel Tanker Trucks (3,000–6,000 Liters)

This fuel tanker truck capacity range is the workhorse for localized, high-frequency fuel delivery needs, a staple in rural areas of East Asia, remote oilfield sites in the Middle East, and agricultural regions of North and South America. Their compact size makes them ideal for navigating narrow village roads in China, unpaved desert tracks in Saudi Arabia, and winding farm lanes in the United States—areas where larger fuel tanker trucks simply cannot operate.

Small fuel tanker truck capacity excels in emergency fuel delivery, such as refueling backup generators at small industrial facilities in Dubai or construction sites in Tokyo, where rapid response is critical. For small-scale fuel retailers, including independent gas stations in rural Mexico or family-owned fuel depots in Vietnam, this fuel tanker truck capacity prevents overstocking, reducing financial risk and inventory management complexity. In the agricultural sector, a 3,000–6,000 liter fuel tanker truck capacity is perfect for refueling tractors, harvesters, and irrigation equipment in the fields, eliminating the need for on-farm storage tanks and ensuring fuel is delivered exactly when and where it’s needed.

Medium-Capacity Fuel Tanker Trucks (10,000–20,000 Liters)

The 10,000–20,000 liter fuel tanker truck capacity is the most versatile option for regional fuel transportation, dominating urban and suburban fuel delivery across all three key regions. This fuel tanker truck capacity strikes the perfect balance between load volume and maneuverability, making it the top choice for refueling urban gas stations in New York, Seoul, and Dubai—facilities with underground storage tanks typically ranging from 20,000 to 50,000 liters. A 15,000 liter fuel tanker truck capacity, for example, can make a meaningful contribution to refilling these tanks in a single trip, reducing traffic disruption in dense city centers while keeping stations well-stocked.

Medium fuel tanker truck capacity is also the backbone of industrial fuel supply for mid-sized manufacturing plants, power generation facilities, and chemical plants in the Middle East’s industrial zones (e.g., Jebel Ali in the UAE) and East Asia’s manufacturing hubs (e.g., Guangdong in China). These facilities have steady, predictable fuel demand, and a 10,000–20,000 liter fuel tanker truck capacity ensures regular, efficient deliveries without the logistical challenges of larger fleets. At regional fuel distribution centers—critical nodes in the fuel supply chain for North America’s interstate network, the Middle East’s cross-border fuel trade, and East Asia’s domestic distribution grid—this fuel tanker truck capacity breaks down large-scale fuel supplies into manageable quantities for local delivery, acting as a vital link between refineries and end users.

Large-Capacity Fuel Tanker Trucks (30,000–60,000+ Liters)

For long-distance and large-volume fuel transportation, large fuel tanker truck capacity (often paired with trailers) is the only viable option, powering the global fuel supply chain from refineries to major distribution hubs. This fuel tanker truck capacity is essential for moving fuel across the vast highways of North America—from refineries in Texas to distribution centers in Canada—where a single 50,000 liter fuel tanker truck can replace five 10,000 liter trucks, slashing fixed costs for drivers, fuel, and tolls. In the Middle East, large fuel tanker truck capacity is used to transport crude oil and refined fuels from Persian Gulf refineries to inland industrial complexes and cross-border markets in the GCC, leveraging the region’s modern, wide-road infrastructure to maximize efficiency.

Large fuel tanker truck capacity is also the primary choice for supplying mega industrial complexes—such as petrochemical plants in Louisiana (USA), oil refineries in Jubail (Saudi Arabia), and power generation plants in Shanghai (China)—facilities with storage requirements in the hundreds of thousands of liters. Airports across the globe, from Los Angeles International to Dubai International and Tokyo Haneda, rely on this fuel tanker truck capacity for aviation fuel delivery, as the high fuel consumption of commercial aircraft demands continuous, large-volume refueling to avoid flight disruptions. A 60,000 liter fuel tanker truck capacity ensures that airport fuel reserves are replenished in a timely manner, even during peak travel seasons in North America’s summer, the Middle East’s winter, and East Asia’s Lunar New Year holidays.

Key Factors Shaping Fuel Tanker Truck Capacity Selection

Choosing the right fuel tanker truck capacity is not a one-size-fits-all process; it requires a deep analysis of four interrelated factors that vary significantly across the Americas, Middle East, and East Asia. Ignoring any of these factors can lead to costly mistakes, from investing in large fuel tanker truck capacity that cannot navigate local roads to using small fuel tanker truck capacity that fails to meet peak demand. For global fuel businesses, aligning fuel tanker truck capacity with these factors is critical to ensuring operational efficiency across all regional markets.

Demand Patterns: Volume and Timing Across Regions

The volume and frequency of fuel demand are the most fundamental drivers of fuel tanker truck capacity selection, with regional variations dictating distinct choices. In high-demand, consistent markets—such as downtown Los Angeles, central Dubai, and Shanghai’s Pudong district—large or medium fuel tanker truck capacity is essential to reduce the number of trips and meet the needs of thousands of daily customers. In contrast, sporadic, low-volume demand in remote areas—like rural Alaska in the US, the Saudi Arabian desert, or mountainous regions in South Korea—calls for small fuel tanker truck capacity to avoid the inefficiency of underloaded large trucks.

Peak and off-peak demand fluctuations also demand flexibility in fuel tanker truck capacity. In North America, summer road trips drive a surge in gasoline demand, requiring gas stations to switch from 10,000 liter fuel tanker truck capacity deliveries twice a week to 15,000 liter capacity three times a week. In the Middle East, winter tourism and industrial expansion increase diesel demand, necessitating larger fuel tanker truck capacity for industrial supply. In East Asia, the Lunar New Year holiday leads to a spike in gasoline consumption for travel, making medium to large fuel tanker truck capacity essential for keeping urban gas stations stocked. Understanding these regional demand cycles ensures that fuel tanker truck capacity is optimized for both peak and baseline needs, avoiding stockouts and excess costs.

Transportation Route Constraints: Global Road and Infrastructure Rules

Road conditions and infrastructure restrictions vary drastically across the Americas, Middle East, and East Asia, and they directly limit viable fuel tanker truck capacity options. In North America, the interstate highway system is designed for large fuel tanker truck capacity, with wide roads and high-weight bridge limits, making 30,000+ liter tankers the standard for long-distance transport. The Middle East’s modern infrastructure—built to support industrial growth—also accommodates large fuel tanker truck capacity, with wide highways and minimal weight restrictions in major industrial corridors.

East Asia, however, presents a more complex landscape: dense urban areas with narrow roads (e.g., Tokyo, Hong Kong) and mountainous regions (e.g., western China, South Korea) restrict large fuel tanker truck capacity, making medium and small capacities the primary choice for local delivery. Even within regions, there are variations: in the US, rural mountain roads in Colorado limit fuel tanker truck capacity to under 10,000 liters, while interstate highways in the Midwest allow 60,000+ liter tankers. In the Middle East, desert tracks to remote oilfields require small fuel tanker truck capacity, while coastal highways to major ports support large capacities. Bridge and tunnel restrictions are also universal: a 50,000 liter fuel tanker truck capacity that is legal in Texas may be too heavy for a bridge in Japan, or too wide for a tunnel in the UAE, requiring a switch to medium fuel tanker truck capacity for that route.

Storage Facility Sizes: Matching Capacity to Loading/Unloading Infrastructure

The size of storage facilities at both the loading (refineries, fuel terminals) and unloading (gas stations, industrial plants) ends is a non-negotiable constraint for fuel tanker truck capacity selection. For the receiving end, a small gas station in rural Thailand with an underground storage tank of only 10,000 liters cannot accommodate a 20,000 liter fuel tanker truck capacity—this would result in incomplete unloading, requiring two trips and doubling operational costs. Instead, a 10,000 liter fuel tanker truck capacity is the perfect match, ensuring full unloading in a single trip and maximum efficiency.

At large-scale unloading points—such as a refinery in Houston (USA), an industrial complex in Riyadh (Saudi Arabia), or an oil depot in Singapore—large fuel tanker truck capacity (30,000+ liters) is ideal, as these facilities have storage tanks of 100,000+ liters and can handle full loads with ease. On the loading side, refineries and fuel terminals in North America and the Middle East are built to quickly fill large fuel tanker truck capacity, reducing loading time and increasing fleet turnover. In East Asia, smaller regional fuel terminals may only have the infrastructure to fill medium or small fuel tanker truck capacity, making these the practical choice for local distribution. Matching fuel tanker truck capacity to storage facility size eliminates inefficiencies and ensures that every trip is a full, cost-effective load.

Cost-Benefit Analysis: Short-Term Investment vs. Long-Term Fuel Tanker Truck Capacity Value

A rigorous cost-benefit analysis is the final critical step in fuel tanker truck capacity selection, and it must account for both short-term purchase costs and long-term operational expenses—factors that impact global businesses equally, regardless of region. Small fuel tanker truck capacity has a low initial purchase cost (typically $$15,000$$30,000 USD), making it an attractive option for small businesses or new market entrants. However, high-frequency delivery with small fuel tanker truck capacity drives up maintenance costs (tire wear, engine loss), driver wages, and fuel consumption for the fleet, leading to a higher per-liter transportation cost.

Medium fuel tanker truck capacity has a moderate purchase cost ($$50,000$$80,000 USD) and balances operational costs with load volume, making it the most cost-effective choice for most regional and urban delivery needs across the globe. Large fuel tanker truck capacity has a high initial purchase cost ($$100,000$$200,000 USD) and higher maintenance costs (due to larger engines, complex braking systems, and heavy-duty tires), but it delivers the lowest per-liter transportation cost for long-distance, high-volume transport. For example, a 30,000 liter fuel tanker truck has a per-liter cost of $$0.015 USD, compared to$$0.03 USD for a 5,000 liter truck—this difference translates to massive savings for annual transportation volumes over 1 million liters.

The break-even point for large fuel tanker truck capacity is typically an annual transportation volume of 500,000 liters, a threshold easily met by fuel distributors serving major industrial clients or long-distance routes in North America, the Middle East, and East Asia. For businesses with lower annual volumes, small or medium fuel tanker truck capacity remains the more economical choice, as the savings from lower purchase costs outweigh the higher per-liter operational costs.

A Step-by-Step Process to Choose the Optimal Fuel Tanker Truck Capacity

To eliminate guesswork and ensure that fuel tanker truck capacity aligns with global operational needs, businesses should follow a four-step, data-driven process that accounts for regional variations, logistical constraints, and long-term growth. This process is applicable to all markets—whether you’re expanding a fuel distribution fleet in the US, launching a new fuel supply business in the UAE, or optimizing delivery routes in China—and it guarantees that fuel tanker truck capacity is not just a logistical choice, but a strategic one.

Step 1: Map Demand Characteristics for Your Regional Markets

Start by defining the fuel demand volume and transportation frequency for each of your target markets, as this will immediately narrow down viable fuel tanker truck capacity options. For small-batch, high-frequency scenarios—such as rural fuel delivery in Mexico, agricultural supply in South Korea, or remote oilfield refueling in Oman—small fuel tanker truck capacity (3,000–6,000 liters) is the only practical choice. This capacity meets single-trip demand (typically 3,000–6,000 liters) and navigates the complex road conditions of these markets, avoiding the efficiency waste of large fuel tanker trucks running half-empty.

For medium-batch, regular-frequency scenarios—urban gas station delivery in Chicago, Dubai, and Shanghai; regional industrial supply in Texas, Guangdong, and Qatar—medium fuel tanker truck capacity (10,000–20,000 liters) is optimal. This capacity balances single-trip volume (10,000–20,000 liters) with road passability, and regular scheduling (2–3 trips per week) ensures stable fuel supply without the cost of frequent small-capacity trips.

For large-batch, low-frequency scenarios—long-distance refinery-to-hub transport in North America, mega industrial complex supply in the Middle East, airport fuel delivery in East Asia—large fuel tanker truck capacity (30,000+ liters) is the best choice. This capacity maximizes load volume for single trips (often 30,000–60,000 liters) on high-capacity infrastructure, slashing fixed costs and reducing the number of trips required for large-volume demand.

Step 2: Evaluate Hard Logistical Constraints Across Routes

After mapping demand, assess the hard logistical constraints that will limit fuel tanker truck capacity for each route and market. For route traffic restrictions, audit bridge load-bearing limits, tunnel height/width, and road conditions for every delivery route. If a route includes mountain roads in Colorado, narrow streets in Tokyo, or desert tracks in Saudi Arabia, large fuel tanker truck capacity is not viable—downgrade to medium or small capacity to avoid logistical delays and safety risks. If a route is a major highway (e.g., Interstate 40 in the US, E11 in the UAE, G15 in China) with no size/weight restrictions, prioritize large fuel tanker truck capacity for maximum efficiency.

For loading/unloading site conditions, measure the storage capacity of every receiving and loading facility. If an unloading point is a small gas station with a 10,000 liter tank, select a 10,000 liter fuel tanker truck capacity to ensure full unloading. If an unloading point is a large oil depot with a 200,000 liter tank, use large fuel tanker truck capacity to fill it in one trip. On the loading side, confirm that fuel terminals can fill your chosen fuel tanker truck capacity quickly—delays in loading reduce fleet turnover and increase operational costs, so align capacity with loading infrastructure.

Step 3: Calculate Whole-Life Cycle Cost-Effectiveness

Once you’ve narrowed down fuel tanker truck capacity options based on demand and constraints, calculate the whole-life cycle cost for each option to identify the most economical choice. This analysis must include initial purchase cost, per-liter transportation cost, maintenance costs, driver wages, and fuel consumption for the tanker fleet. For large fuel tanker truck capacity, focus on the long-term savings from lower per-liter costs and fewer trips; for small fuel tanker truck capacity, highlight the lower initial investment and flexibility for small-volume demand.

Use real-world data to compare options: for example, a 30,000 liter fuel tanker truck has a single-trip cost of $$450 USD (driver, fuel, depreciation) and a per-liter cost of$$0.015 USD, while a 5,000 liter truck has a single-trip cost of $$150 USD and a per-liter cost of$$0.03 USD. For an annual transportation volume of 1.2 million liters, the large truck costs $$18,000 USD in total, while the small truck costs$$36,000 USD— a 50% savings. This analysis will clearly show which fuel tanker truck capacity delivers the best return on investment for your specific annual volume and route mix.

Step 4: Reserve Elastic Space for Demand Fluctuations and Growth

Fuel demand is never static—seasonal changes, economic growth, and business expansion all drive fluctuations—so your fuel tanker truck capacity selection must include elastic space to adapt. For seasonal demand surges, such as summer gasoline demand in North America, winter industrial demand in the Middle East, or holiday travel demand in East Asia, either temporarily deploy larger fuel tanker truck capacity or select a slightly larger permanent capacity to meet peak needs. For example, if your baseline demand is 10,000 liters per trip, a 15,000 liter fuel tanker truck capacity can handle peak demand without requiring additional trips.

For business expansion, select fuel tanker truck capacity based on your 3-year peak demand projections, not just current demand. If your current demand is 10,000 liters per trip and you plan to add industrial clients in the UAE or expand gas station coverage in China, leading to a 3-year demand of 20,000 liters per trip, directly select a 20,000 liter fuel tanker truck capacity. This avoids the cost and disruption of secondary vehicle replacement and ensures your fleet can support growth without logistical bottlenecks.

Innovations Optimizing Fuel Tanker Truck Capacity in 2025

The global fuel transportation industry is evolving rapidly, with new technologies and materials that are redefining what’s possible with fuel tanker truck capacity—boosting efficiency, increasing load volume, and reducing operational costs for businesses across the Americas, Middle East, and East Asia. These innovations are not just incremental improvements; they are transforming fuel tanker truck capacity from a fixed specification to a flexible, optimized parameter that adapts to global operational needs.

Advanced Tank Materials: Lighter Tanks, More Fuel Tanker Truck Capacity

The biggest breakthrough in fuel tanker truck capacity optimization is the use of lightweight composite materials, such as carbon-fiber-reinforced polymers (CFRP), for tank construction. Traditional steel tanks are heavy, limiting the amount of fuel that can be carried within vehicle weight limits— a major constraint for fuel tanker truck capacity across all regions. CFRP tanks are 40% lighter than steel tanks while maintaining the same strength and pressure resistance, meaning a fuel tanker truck with a CFRP tank can carry 10–15% more fuel than a steel-tank truck of the same size and weight. This directly increases effective fuel tanker truck capacity without violating road weight restrictions, a game-changer for long-distance transport in North America and the Middle East.

Corrosion-resistant coatings are another key material innovation, extending the lifespan of fuel tanker tanks and ensuring consistent fuel tanker truck capacity over time. Fuel and environmental factors (e.g., salt in coastal areas of the US, sand in the Middle East, humidity in East Asia) cause steel tanks to corrode, reducing their usable capacity and increasing the risk of leaks. Advanced ceramic and polymer coatings protect tanks from corrosion, ensuring that fuel tanker truck capacity remains at 100% for the life of the tank and reducing maintenance costs by up to 30%.

Aerodynamic Designs: Reducing Fuel Use, Boosting Capacity Utilization

Aerodynamic optimization is critical for maximizing fuel tanker truck capacity utilization, as it reduces the fuel consumed by the tanker itself, freeing up more of the energy budget for transporting cargo fuel. Modern fuel tanker trucks are designed with streamlined shapes—rounded edges, sloping fronts, and tapered rear ends—that reduce air resistance by up to 25% compared to traditional boxy designs. This translates to lower fuel consumption for the tanker: a large fuel tanker truck with an aerodynamic design uses 10–15% less diesel per kilometer than a non-aerodynamic truck, a massive savings for long-distance routes in North America and the Middle East.

Drag-reducing devices, such as side skirts and roof fairings, further enhance aerodynamic efficiency. Side skirts reduce air flow under the truck, while roof fairings smooth airflow over the top, combining to cut drag by an additional 10%. For fuel tanker truck fleets, this means lower operational costs and the ability to transport more fuel within the same energy budget—effectively increasing fuel tanker truck capacity utilization without changing the physical tank size. These designs are now standard for new fuel tanker trucks in North America and the Middle East, and they are rapidly gaining adoption in East Asia’s urban fleets.

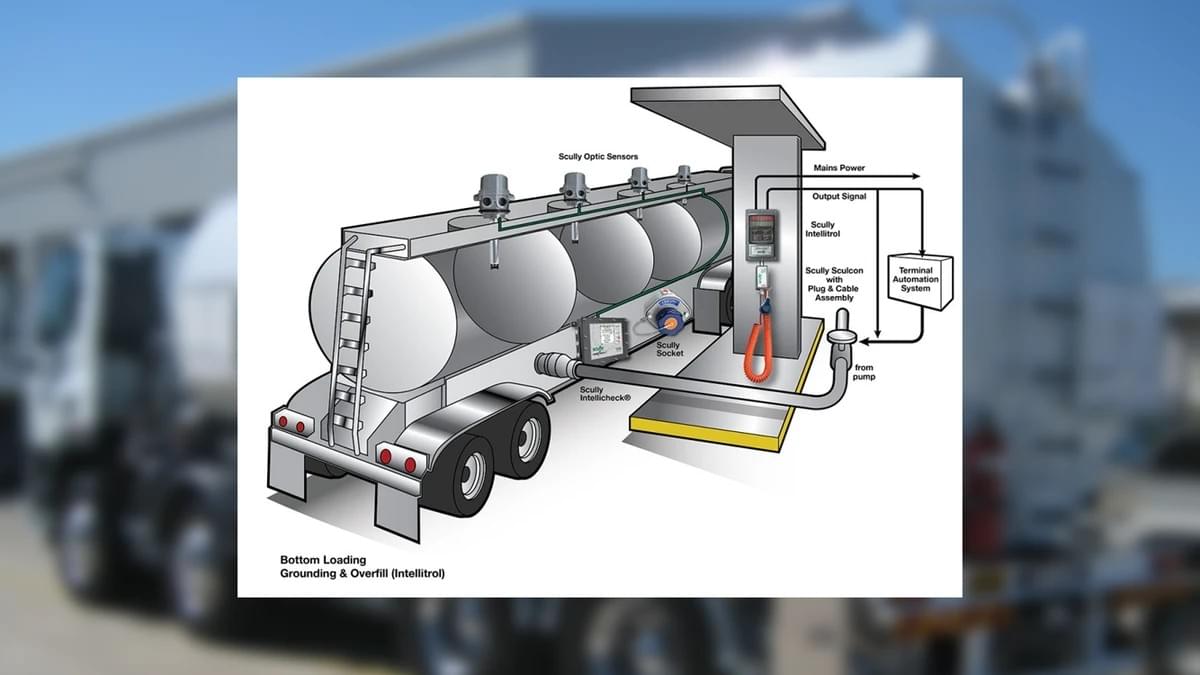

Smart Fuel Management Systems: Maximizing Safe Fuel Tanker Truck Capacity

Smart technology is transforming how fuel tanker truck capacity is used, with real-time monitoring and optimized loading/unloading systems that ensure tanks are filled to their maximum safe capacity on every trip. Smart fuel management systems use sensors to track fuel level, temperature, and pressure in the tanker in real time, transmitting data to a central control center. This allows operators to adjust loading and transportation parameters to maximize fuel tanker truck capacity: for example, if fuel temperature rises (increasing volume), the system alerts the driver to reduce speed to avoid overpressure, ensuring the tank can remain filled to full capacity without safety risks.

These systems also optimize the loading and unloading process, using precise flow meters to measure fuel volume and ensure that the tanker is filled to its exact maximum safe capacity—no more underfilling (wasting fuel tanker truck capacity) or overfilling (creating safety hazards). For fuel distributors, this means every trip uses fuel tanker truck capacity to its full potential, increasing fleet efficiency and reducing the number of trips required to meet demand. Smart systems are now a must-have for fuel tanker fleets operating in the highly regulated markets of North America and the Middle East, and they are becoming standard in East Asia’s rapidly digitizing fuel industry.

How to Source the Right Fuel Tanker Truck Capacity for Your Global Business

Selecting the optimal fuel tanker truck capacity is only half the battle—sourcing high-quality, regionally compliant tankers from a reputable supplier is the other critical step for global businesses. The right supplier will not only provide tankers with the exact fuel tanker truck capacity you need but also offer customization, regional regulatory compliance, and after-sales support—essential for operating across the Americas, Middle East, and East Asia.

Conduct a Thorough Global Needs Assessment

Before sourcing, refine your fuel tanker truck capacity requirements by analyzing historical demand data, regional road regulations, and growth projections for every market you serve. For North American operations, confirm that fuel tanker truck capacity aligns with US Department of Transportation (DOT) and Canadian Transport Canada weight/size limits. For Middle Eastern operations, ensure compliance with GCC road transport standards, which govern fuel tanker truck capacity for cross-border trade. For East Asian operations, adhere to local regulations (e.g., China’s GB standards, Japan’s MLIT rules) that limit fuel tanker truck capacity for urban and rural routes.

Also, consider fuel type compatibility: gasoline, diesel, and aviation fuel each require specific tank designs, and your fuel tanker truck capacity must be paired with the right tank material and safety features for the fuel you transport. For example, aviation fuel tankers require higher-grade corrosion resistance, while diesel tankers can use standard lightweight composites—both with the same fuel tanker truck capacity, but different engineering for safety and compliance.

Evaluate Fleet Compatibility and Driver Training

If you’re adding new tankers to an existing fleet, ensure that the new fuel tanker truck capacity is compatible with your current maintenance infrastructure, driver skills, and logistics software. Large fuel tanker truck capacity requires specialized maintenance (e.g., heavy-duty brake service, large-engine repair) that your current team may not be trained for—invest in training or partner with a local maintenance provider to avoid downtime. For drivers, large fuel tanker truck capacity requires additional training in handling heavy loads, navigating large vehicles, and complying with regional safety rules (e.g., US hours-of-service laws, UAE speed limits for heavy trucks).

Medium and small fuel tanker truck capacity are more compatible with standard maintenance and driver training, making them ideal for fleet expansion in new markets or for businesses with limited specialized resources. Your logistics software should also be able to track and optimize routes for different fuel tanker truck capacities, ensuring that large tanks are assigned to long-distance, high-capacity routes and small tanks to local, high-frequency routes.

Partner with a Reputable, Global Fuel Tanker Supplier

The best fuel tanker suppliers offer a full range of fuel tanker truck capacity options (3,000–60,000+ liters) and can customize tankers to meet regional regulatory and operational needs. Look for suppliers with a track record of serving global markets—North America, the Middle East, and East Asia—and with certifications from international bodies (e.g., ISO, DOT, GCC) that ensure compliance with local safety and transportation standards.

Reputable suppliers also offer after-sales support, including spare parts, maintenance, and technical assistance, across all your regional markets—critical for minimizing downtime for your fuel tanker fleet. Customization options are another key benefit: suppliers can adjust fuel tanker truck capacity, tank material, safety features (e.g., emergency shutoff valves, spill prevention systems), and aerodynamic design to match your exact operational needs, whether you’re delivering gasoline to rural China or aviation fuel to Dubai International Airport.

Conclusion: Fuel Tanker Truck Capacity as a Global Strategic Asset

In the global fuel transportation industry, fuel tanker truck capacity is not just a logistical specification—it is a strategic asset that shapes supply chain efficiency, cost competitiveness, and market reach across the Americas, Middle East, and East Asia. The optimal fuel tanker truck capacity is the one that aligns perfectly with your regional demand patterns, logistical constraints, and long-term growth goals—whether that’s a 3,000 liter small capacity for rural delivery, a 15,000 liter medium capacity for urban supply, or a 50,000 liter large capacity for long-distance transport.

By following the step-by-step process outlined in this guide—mapping demand, evaluating constraints, calculating cost-effectiveness, and reserving elastic space—you can select fuel tanker truck capacity that eliminates inefficiencies, reduces operational costs, and ensures seamless fuel delivery across all your global markets. And with the latest innovations in materials, aerodynamics, and smart technology, you can maximize fuel tanker truck capacity utilization, boosting efficiency even further and staying ahead of the competition in the dynamic global fuel industry.

If you’re ready to optimize your fuel tanker truck capacity for global operations—whether you’re expanding your fleet, entering new markets, or upgrading your existing tankers—our team of fuel transportation experts is here to help. We offer a full range of fuel tanker truck capacity options, customized to meet regional regulatory and operational needs, with global after-sales support and expert advice to ensure you make the right choice for your business. Contact us today to start your fuel tanker truck capacity optimization journey and unlock the full potential of your global fuel distribution network.